Debit Coin was designed with project development and management in mind. There are 100 million in existence and this amount can’t be increased unless a clear majority of Debit Coin holders agree.

Debit Coin’s worth is solely based on the exchange rate against CENTUS and the dividends that currency pays. When there’s more demand for CENTUS and the smart contract makes more of it in line with demand, Debit Coin holders get the new tokens pro rata if and when all remaining BILLEX tokens have been redeemed and CENTUS holders have received them. The dividend rate for Debit Coin holders goes up in line with the CENTUS cap level.

Debit Coin holders receive their dividend when CENTUS is worth a minimum of $10 million. As the system expands and more CENTUS are circulated, the rate at which the dividend accrues for Debit Coin holders will gradually rise from 10-50% of the total amount of dividends accrued.

Debit Coins can always be exchanged to CENTUS at the current rate of exchange. The higher the Debit Coin rate, the more CENTUS one can receive (up to the 500 CENTUS limit). Debit Coins can only be exchange one time, after which they are removed from circulation.

Consequently, Debit Coin holders shoulder the most risk, and in some ways it’s a bit like holding ordinary shares in a company, whereas CENTUS is closer to holding preference shares that guarantee dividend accumulation, except you don’t get the voting rights and the large dividend payouts.

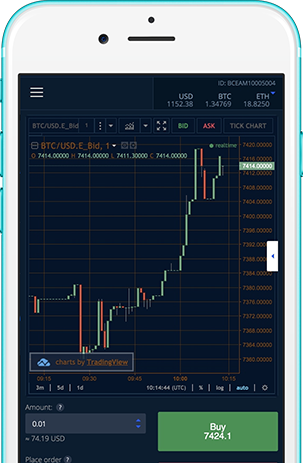

Buy Debit Coin with Transccrypt to make sure that you don’t miss out when values rise. If you buy Debit Coin with Transcrypt early enough, then you won’t miss the boat when it inevitably comes, and if you don’t buy Debit Coin with Transcrypt now then you’ll certainly wish you had later!