Why to use Transcrypt Merchant Tools?

Very fast global payments

Easy acceptance of cryptocurrencies Transcrypr Merchant Tools. enables you to easily accept payments in cryptocurrencies at your Point of Sale or via Invoice.

No Volatility Risk

The exchange rate risk is completely taken over by Transcrypt by reflecting the current locked in exchange rate in the QR code generated for the payment.

Quick bank settlement

Instant payout in FIAT money to your IBAN with Transcrypt. The FIAT withdrawals are allowed the same day!

Personalised solution

You can generate your personalised Invoice with your Logo and details directly from your Merchant dashboard.

How it works?

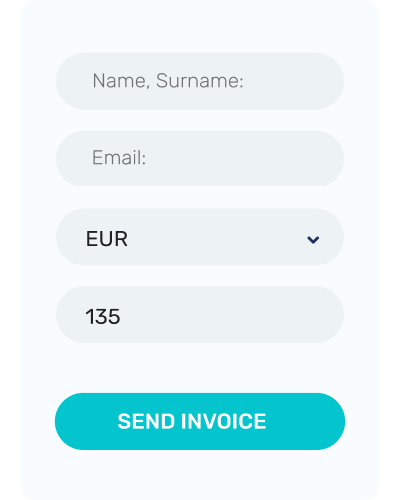

1. Send invoice

Create a bill from your merchant dashboard and send to your client.

2. Payment

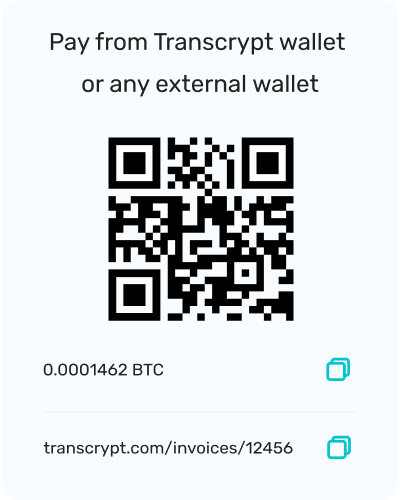

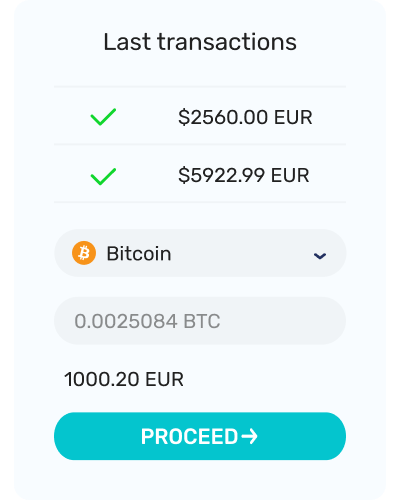

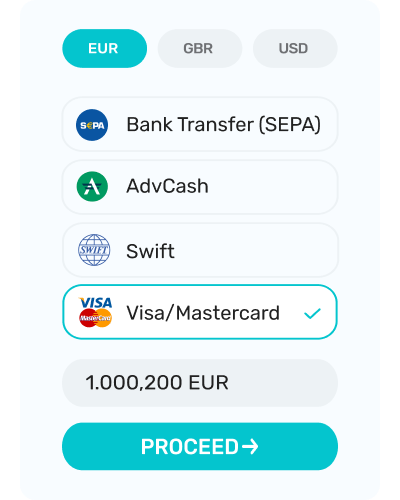

You customer gets an e-mail payment link with QR code with the locked in Exchange rate. You customer can choose BTC, ETH, LTC, USDT or other crypto to pay with.

3. Conversion

Transcrypt converts the customer’s payment into your local currency.

4. Transfer

Transcrypt initiates a bank settlement to you the next business day.

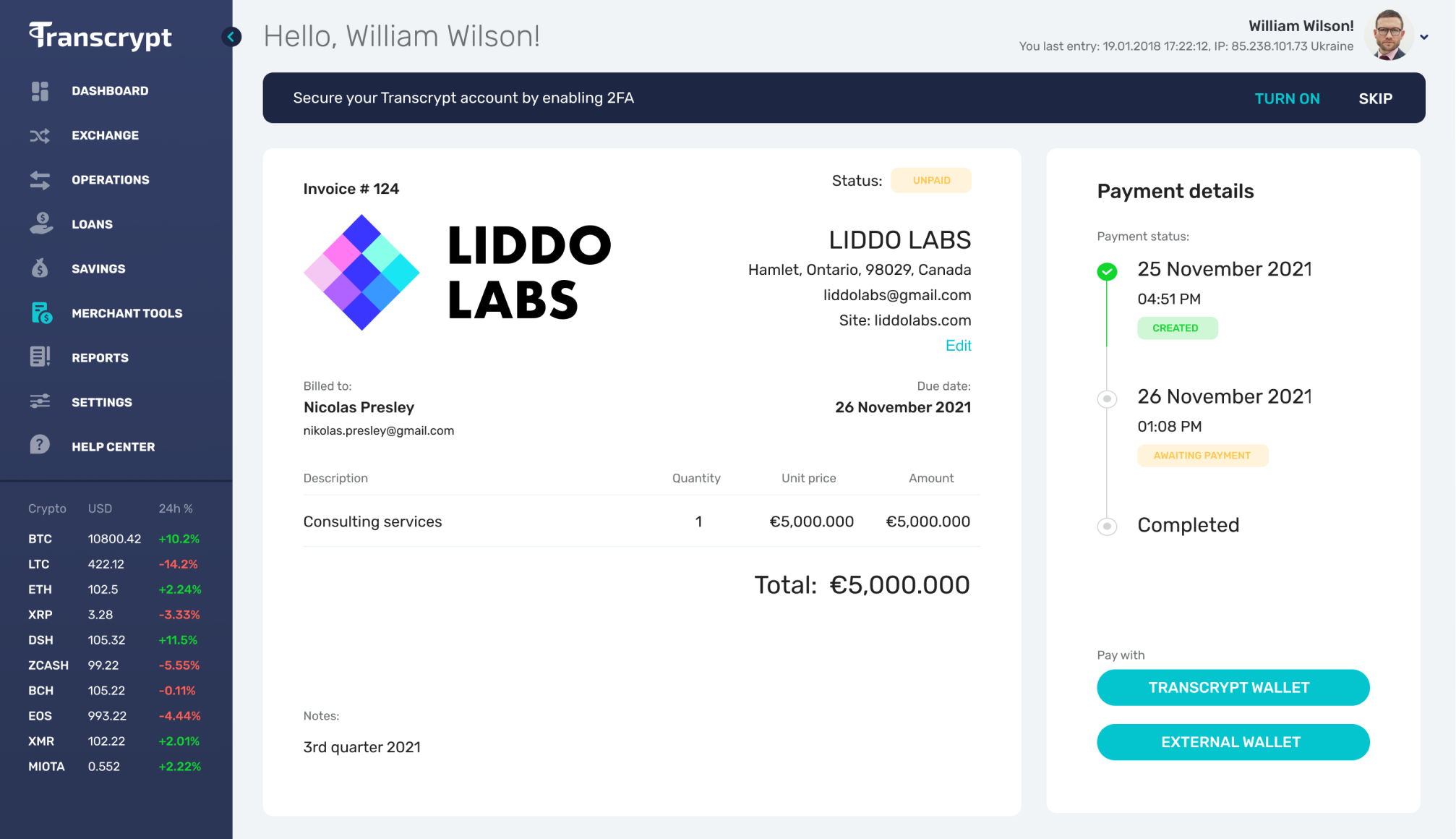

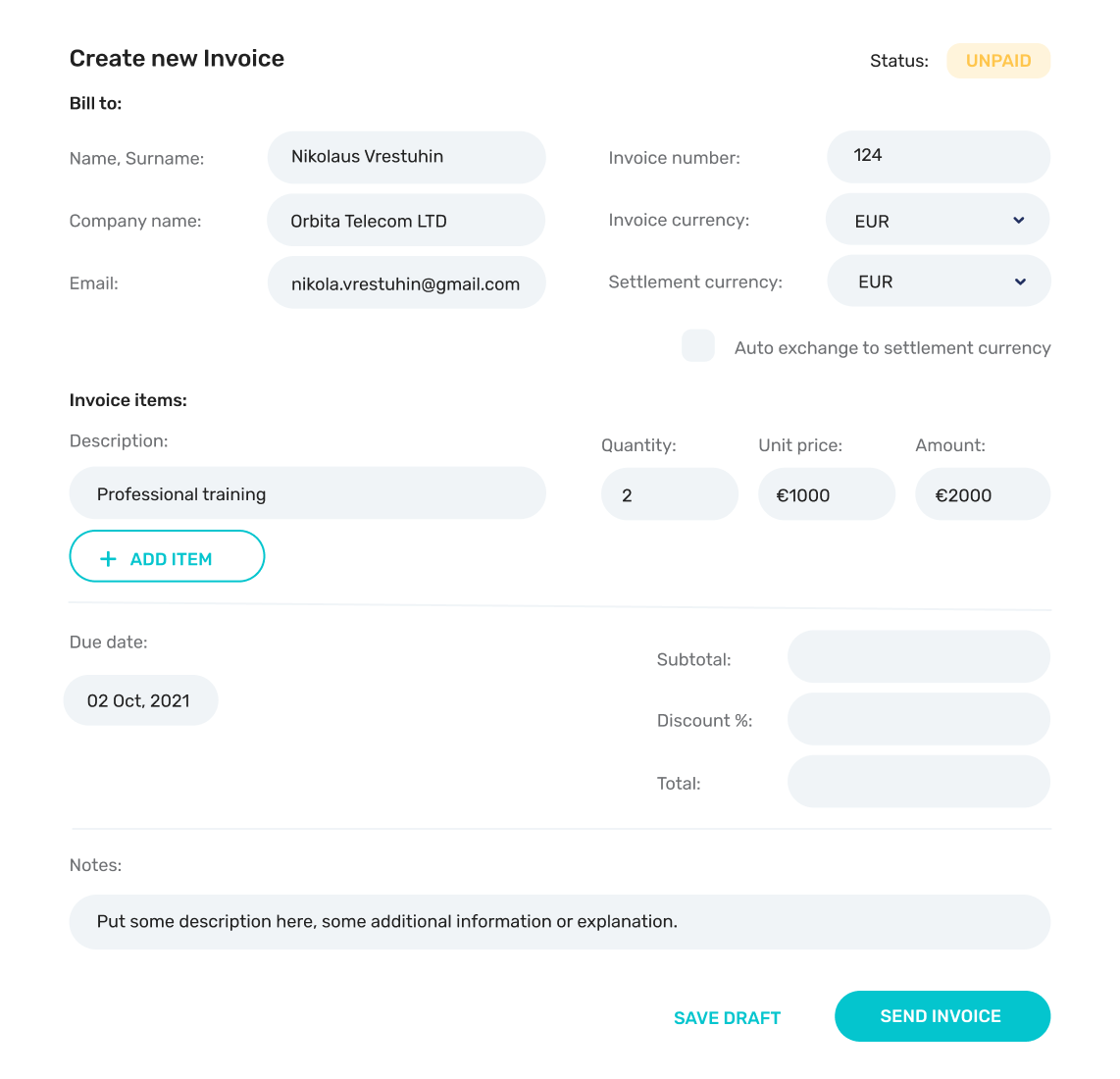

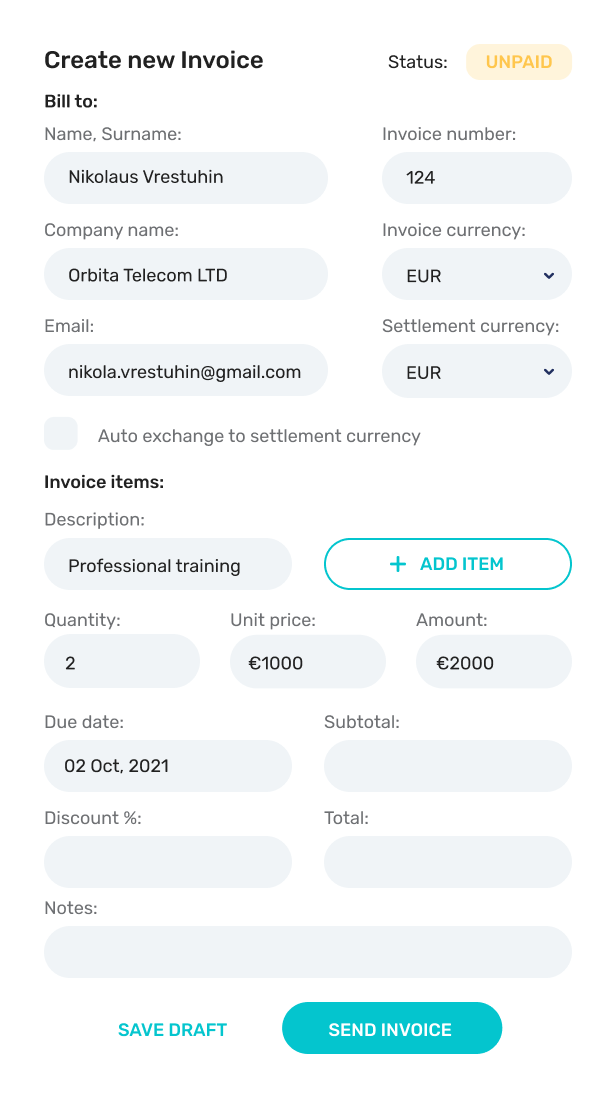

How does it look like?

Invoice number

1Invoice currency

2Real-time payment status

3Settlement currency

4Quantity, price

5Subtotal

6

Invoice number

?The number of your invoices can be customized, to make sure they are in sync with your preferred accounting software.

Invoice currency

?The invoice currency can be adjusted based on the currency you prefer and/or are required to bookkeep in. Currently, the following currencies are supported to denominate your invoices: USD, EUR, GBP

Real-time payment status

The payment status field shows you the real-time status of payments associated with your invoice. This is set to draft while creating an invoice and will change to awaiting payment after successfully issuing your invoice to its recipient.

Settlement currency

You can adjust the currency to be settled in. (The crypto paid by your client will be automatically converted into your chosen settlement currency)

Quantity, price

You can select the payment due date according to your needs, giving you a range of options including a customized date. When untouched, the default due date on an invoice is set to 30 days.

Subtotal

?The recipient details field specifies to which email the invoice will be sent, and allows you to specify further business details for compliance purpose

Due date selection

?The item description field lets you specify in detail which products/services you’re creating an invoice for.

Recipient details

Quantities, prices can be specified per item and are calculated automatically.

Item selection

The subtotal & amount due field shows the total sum payable for your invoice, taking into account all items and associated quantities, prices.

Add new item

?The add item button allows you to add an additional item to your invoice.

Note to recipient

?You can attach a note to your invoice to give more details/context, or to simply thank the recipient for doing business with you.

Due date selection

Recipient details

Item selection

Add new item

Note to recipient